- News Updates

- PSU Watch

- Defence News

- Policy Watch

- हिन्दी न्यूज़

- Jobs Watch

- States News

- Event News

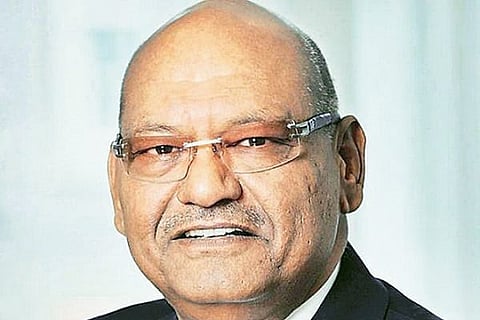

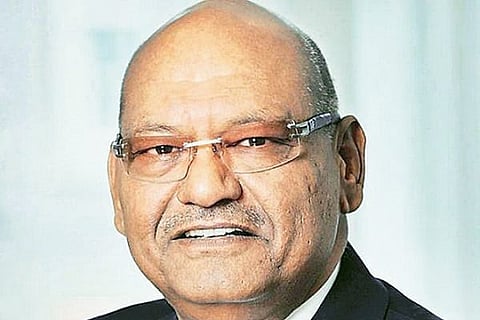

New Delhi: Vedanta Resources Limited Executive Chairman Anil Agarwal announced on Friday the creation of a $10-billion fund, along with London-based Centricus, to invest in the government's mega PSU disinvestment plan. In a tweet, Agarwal said, "Teamed up with London-based firm Centricus to create a $10 bn fund that will invest in stake sale of public sector companies. We are excited with the Union Budget's strong focus on disinvestment and would like to participate in the exercise."

He also said that companies like Hindustan Zinc and Bharat Aluminium Company Ltd (BALCO) prove his track record of turning around companies post disinvestment without retrenching a single employee. "@Hindustan_Zinc & @Balco_India exemplify our track record of turning around companies post disinvestment without retrenching a single employee," Agarwal said on Twitter.

Agarwal has also thrown its hat in the ring to acquire the government's stake in state-run Bharat Petroleum Corporation Ltd (BPCL).

In the past, Agarwal has been vocal about his opinion on PSUs, saying that the government should not be in business. The Vedanta Chairman has also urged the government to undertake the privatisation of Hindustan Copper Ltd (HCL). In October 2020, he applauded the Niti Aayog for spearheading a conversation on the disinvestment of the copper PSU.

(PSU Watch– India's Business News centre that places the spotlight on PSUs, Bureaucracy, Defence and Public Policy is now on Telegram. Join PSU Watch Channel in your Telegram and stay updated)